Fed rate hike

The increase comes following the latest consumer price index report showing that inflation. Economists expect Fed Chair Jerome.

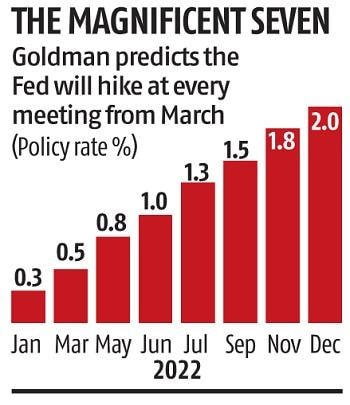

Now Goldman Expects 7 Us Federal Reserve Rate Hikes In 2022 Business Standard News

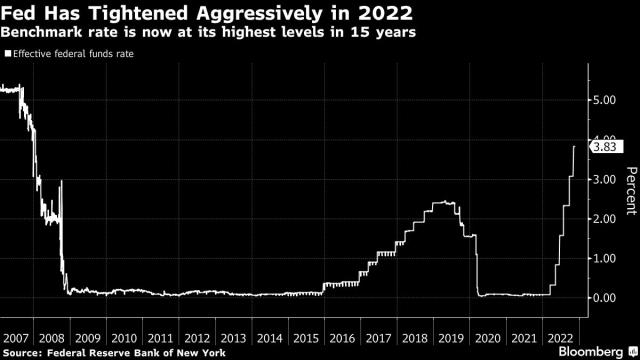

Web 1 day agoThe Feds rate-setting committee hiked its benchmark rate by 05 percentage point on Wednesday lifting its target rate into a range between 425 and 45 the highest level in 15 years.

. Each time the Federal Reserve. Web 2 days agoThe Federal Reserve is expected to raise interest rates by a half percentage point Wednesday yet signal it will continue its battle against inflation. Adjustable-rate loans such as ARMs that are no longer in the fixed-rate period and credit cards with variable rates often see higher interest rates when the Fed hikes their benchmark rate.

Web The Feds rate hikes have had a clear impact on the housing market with surging mortgage rates helping to put a dent into home sales. This will however be the smallest of the last four rate hikes showing promise that the increases will slow soon. During his post-meeting conference Fed Chair Jerome Powell signaled the central.

Web The Federal Reserve will raise interest rates just one more time in November before it stops due to a soaring US dollar according to market veteran Ed Yardeni. Thats why the average 30-year fixed rate mortgage rate increased by about 450 basis points between January 2021 and October 2022 compared with just 300 basis points for the federal funds rate. Web The Federal Open Market Committee said it was increasing its key federal funds rate by 05 after announcing four-straight 075 hikes at its most recent meetings.

Web The combined effect of QT and fed funds rate hikes shows up in interest rates tied to both benchmarks like mortgage rates. Web The Federal Reserve has announced that it will raise interest rates another 05 percent to 45 percent marking the seventh increase of 2022. Web The latest hike moved the Feds target funds rate range to between 375 and 4 the highest since 2008.

Web 1 day agoAnd they could go up even more after yesterdays Fed rate hike. In its Wednesday statement the. Web For borrowers and consumers the fed rate hike means that many types of financing will cost more due to higher interest rates.

That point of view runs counter to market consensus which currently expects a 75 basis point rate hike in November followed by a 50 basis point rate hike in December.

S Ds On Expected Interest Rates Hike We Must Avoid Mistakes Of The Past And Protect The Most Vulnerable Europeans Socialists Democrats

Fed To Slow To 50 Basis Point Hike In September Recession Worries Grow Reuters Poll Shows Reuters

/cloudfront-us-east-2.images.arcpublishing.com/reuters/IT4N4ITWX5P2VPYL2FZW63IQYE.png)

Analysis Hot Inflation Fuels Case For Big Bang Fed Rate Hike In March Reuters

Most Fed Officials Seek To Slow Pace Of Interest Rate Hikes Soon

Treasury Two Year Yields Head For 4 Ahead Of Big Fed Rate Hike

Doshi Associates Cpa Pllc Interest Rate Hike

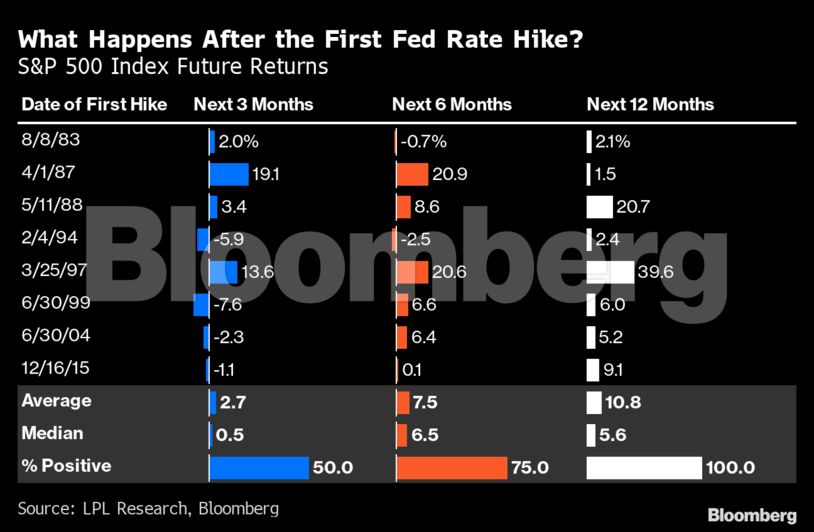

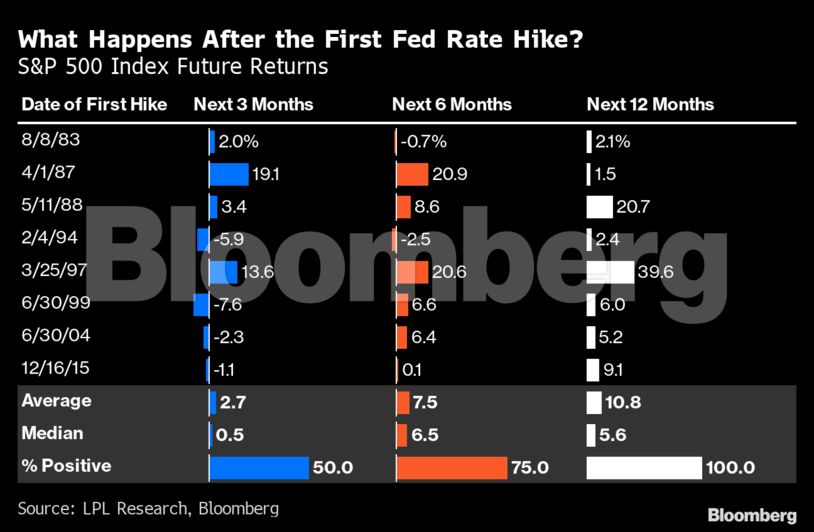

Fed Rate Hike What Happens To Stock Markets When The Fed Hikes Rate A Peek Into History The Economic Times

About Those Fed Rate Hikes They Might Take Longer Than You Think Chief Investment Officer

Fed Rate Hike Expectations Push Us Dollar Higher Traders Trust

The Fed Raises Interest Rates By 0 75 Percentage Points To Tackle Inflation The New York Times

Interest Rate Hike What It Means Saskatoon Residential

Us Fed Raises Interest Rates To Fight 40 Year High Inflation World Economic Forum

Fed Members Expect Three Rate Hikes In 2022 Chart Of The Day Edelweiss

6 Strategies To Predict The Chance Of A Fed Rate Hike In 2022 Dttw

Savers Have Yet To Benefit From This Fed Rate Hike Cycle Marketwatch

Ud4laowe1j9e3m

Fed Hikes Rates By 0 75 Percentage Point Biggest Increase Since 1994