Va mortgage lenders for poor credit

No home equity loans available. Here are the 8 best mortgage lenders for September 2022 including Rocket Mortgage Bank of America Navy Federal and Guild Mortgage.

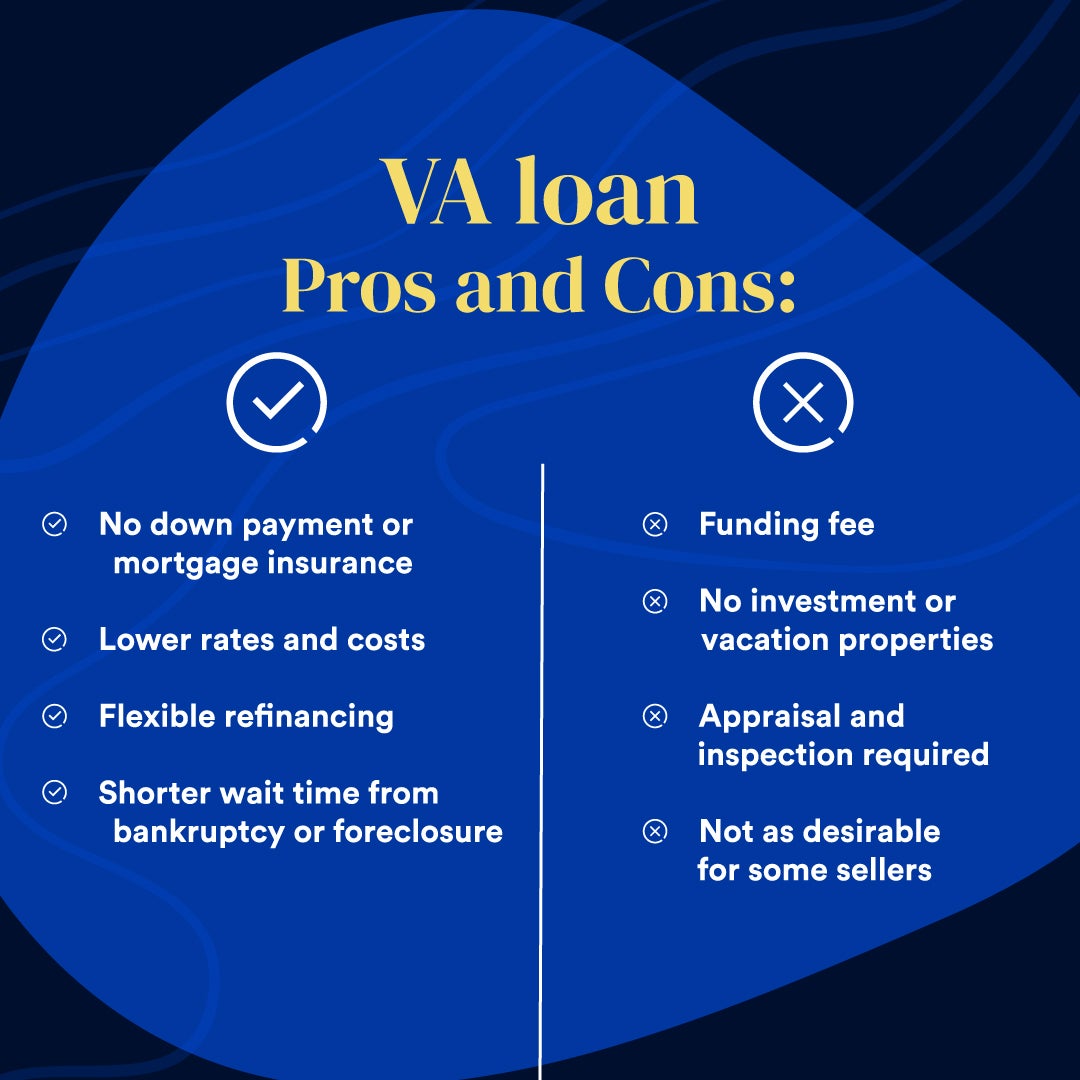

Va Loans Pros And Cons Bankrate

35 with a 580 credit score or higher.

. 10 with a 500 579 credit score. Browse todays VA mortgage rates and compare VA loan options. Founded in 2002 and built for veterans Veterans United Home Loans was honored in 2019 by the Department of Veterans Affairs for issuing the official 24 millionth VA mortgage for the VA program.

VA guaranteed loans are sourced by private lenders including banks credit unions and mortgage finance companies. Poor credit is 300 to 579. 640 when using a USDA-approved lender.

Why Some VA Lenders do Not Accept Poor Credit. Consumers on the. Minimum conventional loan credit score needed.

Fair credit is between FICO scores 580 and 669 to upper 600s. VA loans are typically offered with loan terms of 15 or 30 years. Lenders have to explain why they approve any loan above a 41 limit.

At Rocket Mortgage youll need a score of at least 580 to be eligible for a VA loan. How to shop for a mortgage without hurting your credit score May 6 2022 Conventional Loan 3 Down Available Via Fannie Mae Freddie Mac April 8 2015 3 Down payment mortgages for first-time. Most lenders require a minimum credit score of 580 and a 35 down payment for an FHA loan but you could qualify with a credit score between 500 and 579 and a 10 down payment.

The same is true for mortgage lenders and their credit score minimums. Basic housing sustenance allowance count toward qualifying. No home equity loans available.

A lender will charge a mortgage origination fee in order to process the loan. No down payment required. Very Good credit FICO scores between 740 to 799.

Another 10 are in the 600 to 649. Guild Mortgage offers government-backed FHA VA and USDA loans and can help. They offer loan amounts between 150000-3000000.

Minimum Down Payment 5. ARM FHA Reverse Mortgage USDA VA. It also backs cash-out refinance loans.

But the preapproval process can take longer if you have a past foreclosure bankruptcy IRS lien or poor credit. Here are the 8 best mortgage lenders of September 2022. When you use a VA loan there are limits on the fees that lenders can charge.

Online credit counseling program available for borrowers with poor credit history. VA lenders are protected from part of the loss in the event of a foreclosure or default. Rocket Mortgage requires FHA borrowers to have a score of at least 580.

The amount they are insured for by the VA based upon your entitlement calculation so it is not a 100 coverage or guarantee by the VA. About 15 of American consumers have credit scores in the 500 to 599 range on an 850-point scale which is considered poor to fair credit according to FICO. The window is typically 14 days though it could be longer.

Department of Veteran Affairs the VA offers or guarantees home loans to eligible military active-service members reserve and National Guard members and veterans. FHA loans are insured by the Federal Housing Administration making them less risky for lenders and because of this easier to qualify for than conventional. If youre shopping for a mortgage you have a window of time where multiple credit inquiries by lenders are counted as a single inquiry for your credit scores.

Here are the 8 best mortgage lenders of September 2022. Across the spectrum of VA lending a 620 FICO score is a common credit score minimum. Good credit is 760 to 739s range.

FICO scores between 800 and 850. But that benchmark can be higher or lower depending on the lender the economic environment how much youre hoping to borrow and more. These include a VA funding fee the loan origination fee your credit report discount points title insurance and more.

Angel Oak Mortgage Solutions offers a variety of non-qm loan programs including bank statement loans 1099 income mortgages asset depletion loans jumbo loans conventional mortgages and an investor cash flow mortgage program. Some VA lenders might be fine with a 580 FICO score. Some lenders even offer FHA loans with a credit score as low as 500 though this is far.

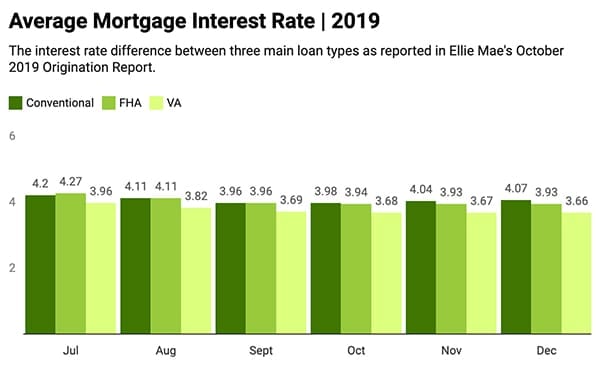

Bad Credit Lenders There are lenders who offer mortgage programs. Its vital to know that mortgage lenders have access to industry-specific scores. VA Mortgage rates are extremely competitive but vary from lender to lender.

None if going directly with the USDA. No down payment required. The VA doesnt set a minimum credit score for VA loans but many lenders have their own limits on which scores theyll allow.

VA loans do not have a minimum credit score. Good for home renovation. As we said most lenders including Rocket Mortgage require a minimum credit score of 620 for a conventional mortgage.

Most lenders look at back-end DTI ratio. Online credit counseling program available for borrowers with poor credit history. Many lenders will issue government-backed FHA and VA loans to borrowers with credit scores starting at 580.

Each lender decided based on a variety of factors for each veteran. Minimum credit score. None but most lenders look for 620.

You can use their quick quote form to see what you may qualify for. DTI Ratio FHA loans. However VA lenders may impose their own minimum score requirements.

Ultimate Home Buyers Checklist Save Time Money House Down Payment Home Financing Mortgage Loans

Pin Page

Trustlink Mortgage Broker Plano Tx Mortgage Lenders Mortgage Brokers Va Loan

:max_bytes(150000):strip_icc()/veteransunited-b0729646b8704c3d802b67aab5567c65.jpg)

Best Va Loan Rates Of 2022

How To Get A Bad Credit Home Loan Lendingtree

If You Want To Get Quick And Easy Loan In Red Deer Apply For A Car Title Loan All You Need To Have Is A Va Bad Credit Car Loan Loans

Fha Vs Va Loan Comparing The Two Loan Programs In Detail

Loan Application 1003 2005 Loan Application Mortgage Payoff Mortgage

Pin On Finance Budgeting

What S Considered A Good Credit Score In 2019 For Getting Approved For A Kentucky Mortgage Loan Credit Score Good Credit Score Good Credit

Va Home Loan Credit Score Requirements 2021

Veterans United Home Loans Mortgage Reviews 2022 Credit Karma

Va Home Loans Down To A 500 Credit Score

Pin On Credit Scores Needed To Qualify For A Kentucky Fha Va Khs Usda And Rural Housing Mortgage Loans

Va Loans All Your Veteran Mortgage Questions Answered

How Long Do You Have To Wait To Buy A House Again In Kentucky After A Bankruptcy Or Foreclosure Mortgage Tips Mortgage Approval Mortgage Lenders

Credit Score Management Tips For Mortgage Loan Applicants Mortgage Quotes Mortgage Loans Mortgage Tips